ad valorem tax florida exemption

Ad valorem means based on value. HOMES FOR THE AGED.

Homestead Exemption Attorney Miami Martindale Com

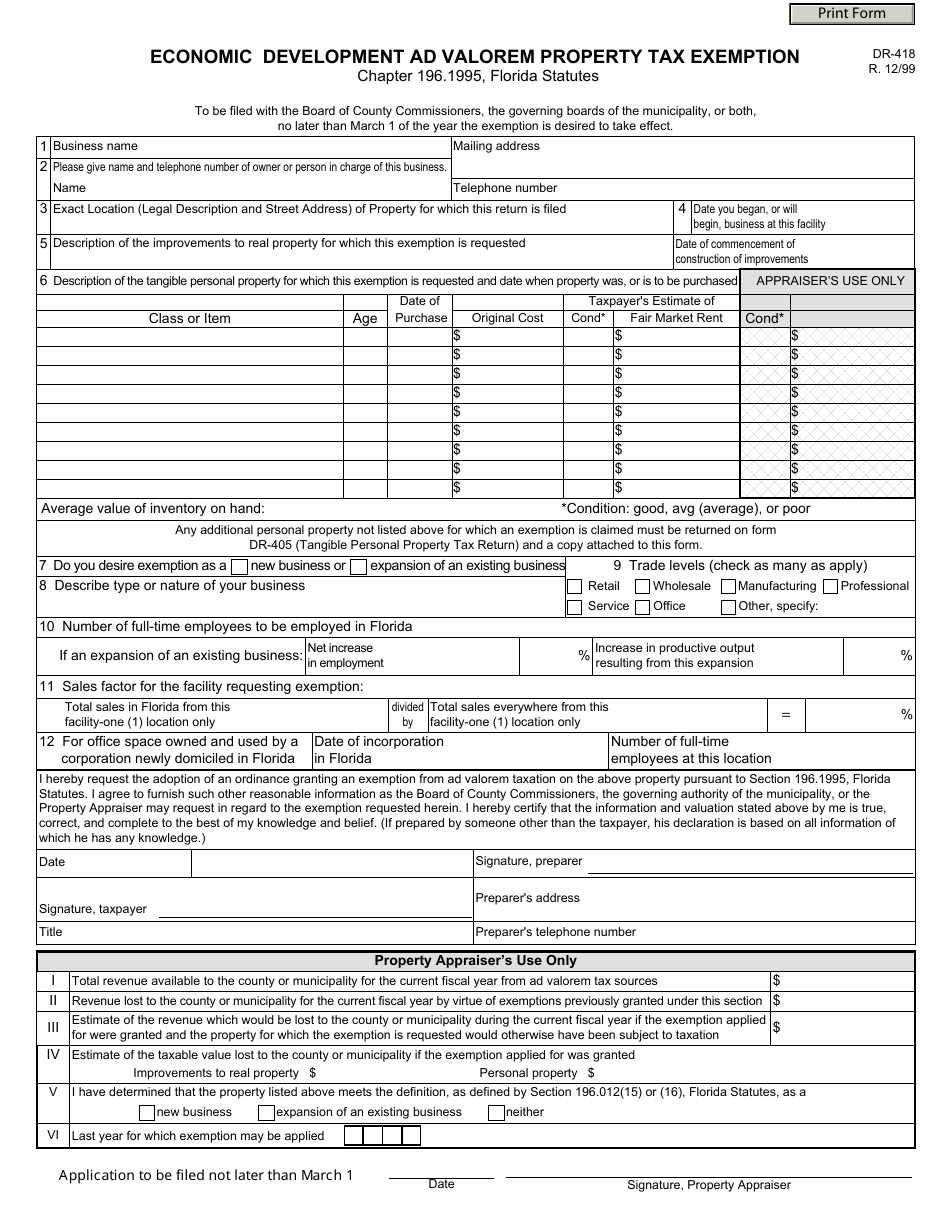

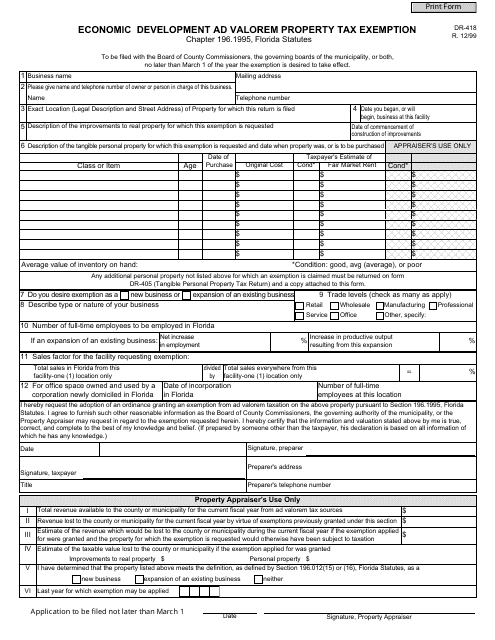

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect.

. Fort Walton Beach FL 32547-5068. The greater the value the higher the assessment. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Property Tax Exemption for Historic Properties. Taxes usually increase along with the assessments subject to certain exemptions. This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances allowing a property tax exemption for up to 100 of the increase in assessed improvements resulting from an approved rehabilitation of a qualified historic property.

This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an exempt purpose as provided in sections ss 196195 196196 and 196197 Florida Statutes FS select all that apply. However the Chamber of Commerce fought back successfully winning back their exemption from the First District Court of Appeals. City of Tallahassee 325 So2d 1 Fla.

Florida Administrative Code. To protect your confidentiality please file by mail or call 407 836-5044. The tax exemption runs for a period of 10 years.

196182 Exemption of renewable energy source devices. 1 Eighty percent of the assessed value of a renewable energy source device as defined in s. 196199 Government property exemption.

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. All property of the United States is exempt from ad valorem taxation except such property as is subject to tax by this state or any political subdivision thereof or any. This is in response to your request for an Attorney Generals Opinion on substantially the following questions.

Recently Alachua County denied a longstanding exemption from the Gainesville Area Chamber of Commerce which had been previously operating under an ad valorem property tax exemption for charitable purpose. 3 a State Const and s. The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average salaries to locate here.

Property owned by a church and leased to a municipality for use by the municipality as a municipal parking lot for which parking fees. Have you qualified under Section 501c3 United States Internal Revenue. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION.

Municipal ad valorem tax exemptions are available only for property owned and used by a municipality for municipal or public purposes pursuant to Art. Organizations filing for exemption under any of these categories must include the following information in addition to completing Sections A B. The most common ad valorem taxes are property taxes levied on real estate.

Bldg 7 Suite 717. Subscribe to Our Newsletter Subscribe Location. When the 10 years have lapsed the tax exemption is removed from that folio number and the building is assessed as normal.

3 portability of an under-assessment the amount by which the. Check all that apply. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The applicant must submit both the application and all affidavits to. Property appraisers will notify you if additional information or documentation is needed to determine eligibility for the exemption or discount requested.

Back to Top Page Last Edited. 196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

At least 38 counties and 20 cities in Florida also have this incentive and it. In Florida local governments are responsible for administering property tax. Santa Rosa County property taxes provide the fund local governments to provide.

Economic Development Ad Valorem Tax Exemption. Ad Valorem Tax Exemption Application and Return Not-For-Profit. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Walden 210 So2d 193 Fla. An ad valorem tax is based on the assessed value of an item such as real estate or personal property. Mon Jun 24 2019 43635 PM.

Save Time Signing Documents from Any Device. I certify all information on this application including any attachments is true correct and in effect on January 1 of the tax. A Is installed on real property on or after January 1 2018.

1170 Martin Luther King Jr Blvd. Exempt purposes before granting an ad valorem tax exemption. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR MULTIFAMILY PROJECT AND.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect. Section 1961978 Florida Statutes.

PO Box 4097. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. 193624 that is considered tangible personal property is exempt from ad valorem taxation if the renewable energy source device.

The 2021 Florida Statutes. 1 The Board of County Commissioners or. May a board of county commissioners pursuant to s.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Did you posses a valid license granted under Chapter 395 or 400 Florida Statutes on January 1 of this year. Sections 196195 196196 and 196197 Florida Statutes.

Hillsborough County Aviation Auth. TAXATION--Economic development ad valorem tax exemption. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now.

Ad Valorem Tax. The Florida Supreme Court has held that land owned and used by the state or by a county is immune from ad valorem taxation. This application is for use by owners of affordable housing for persons or families with certain income limits as provided in section s 1961978 Florida Statutes FS to apply for a select one.

2 a 3 cap on the annual increase in the ad valorem tax value of the home. State ex rel. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

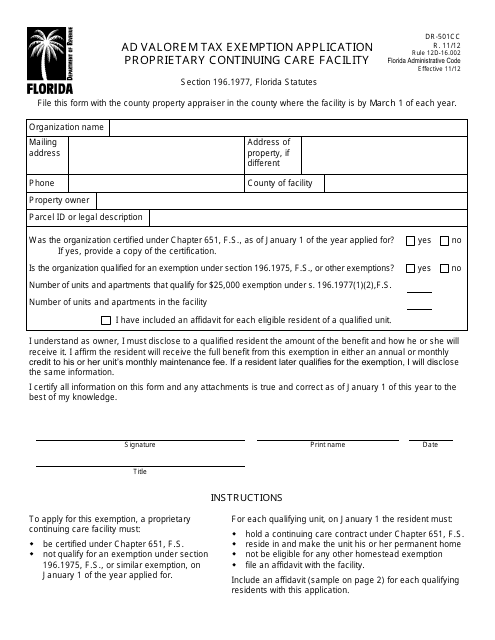

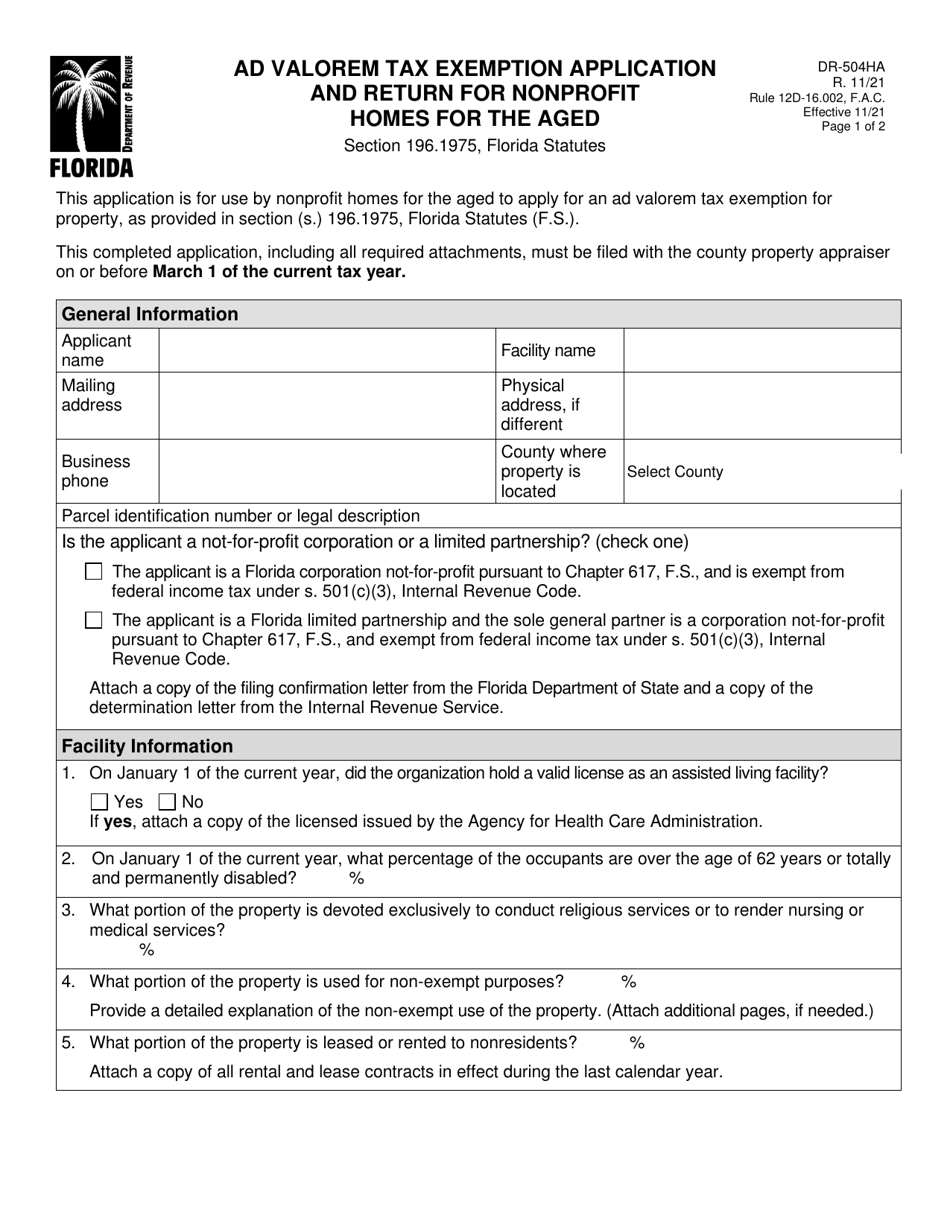

Section 1961995 Florida Statutes requires that a referendum be held if. The updated Ad-Valorem Tax Exemption package and application is now available for review. Ad Valorem Tax Exemption Application and Return for Nonprofit Homes for the Aged Form DR-504HA incorporated by reference in Rule 12D-16002 FAC.

1961995 FS grant an economic ad valorem tax exemption for an expansion. If your parcel ownership is confidential on our web site per Florida Statute 119071 4d1-6 you will be unable to complete an exemption application on-line. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions.

The program enables Pinellas County to more effectively stimulate job creation.

What Is A Homestead Exemption And How Does It Work Lendingtree

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Florida Homestead Exemption How It Works Kin Insurance

Understanding Your Tax Bill Seminole County Tax Collector

On Line Extra Marion County Property Appraiser

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Form Dr 501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

A Guide To Your Property Tax Bill Alachua County Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Real Estate Taxes City Of Palm Coast Florida

Real Estate Property Tax Constitutional Tax Collector

Fill Free Fillable Forms For The State Of Florida

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

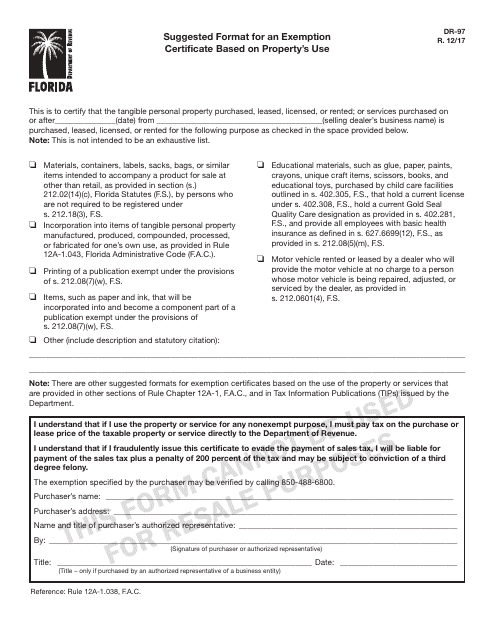

Form Dr 97 Download Printable Pdf Or Fill Online Suggested Format For An Exemption Certificate Based On Property S Use Florida Templateroller

Fl Dr 501 2021 2022 Fill Out Tax Template Online Us Legal Forms